The Future of Biotechnology for Medical Applications in 2005, Biotech Market

The Biotech Market

What is the structure of biotech industry?

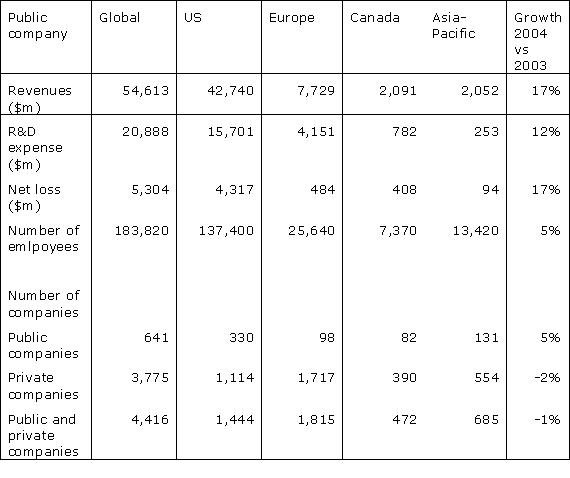

Before answering this question, it is interesting to see which difference in size exists between Biotech and Pharma companies. The market capitalization of the total Biotech industry is 358 billion $ (March 2005). The two largest Pharma companies alone, Merck and Pfizer, have a market capitalization of 275 billion $. This data shows that the Biotech industry still has a long way to go to overhaul the pharma industry. Nevertheless Biotech is growing rapidly in terms of turnover and R&D expenses. In the summary below some key data regarding public companies are displayed that show te structure of the Biotec industry:

Global biotechnology in 2004

Data of private companies are not disclosed, that is why only public data is mentioned.

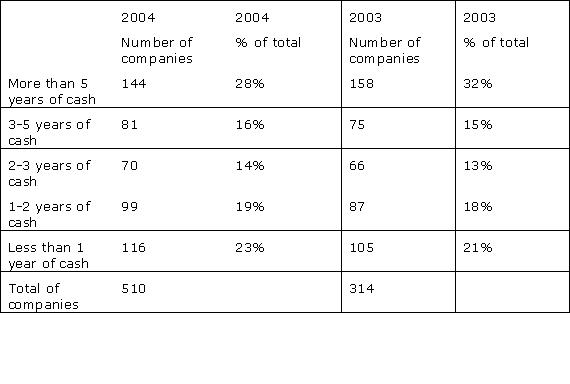

As you can read in the table above, the total Biotech industry has been making losses for years now. Ernst&Young estimated in the Resurgence report of 2004 that the Biotech industry will become profitable in 2008. To have an estimation about if this future will come fast enough, the available cash is used as graduated scale to predict:

Survival index Global public Biotech companies

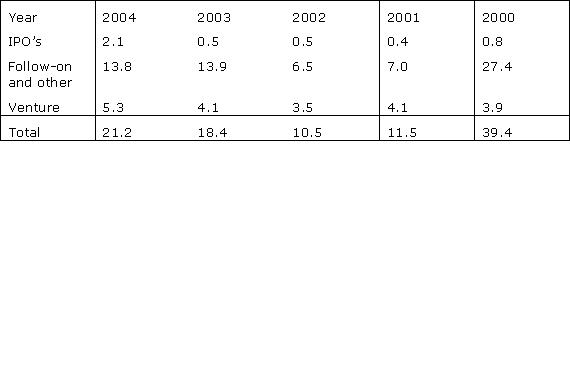

The major investors can be summarized as:

Global financing (in billion $)

Venture capitalist invested 17.5 billion $ in 2004. This investlevel is on the same level as 1997. Compared with the commitments to Biotechnology that peaked in the year 2000 with 82.6$ per year this level can be seen as moderate.

Overall the US is the largest Biotech player in the world by far. Since the costs of research and development are around 800 million $ to bring a blockbuster medicine to the market, cost cutting trends are expected. As you can see in the survival index cash is floating away rapidly and to continue to invest in R&D the expenses ave to come down. The largest part of costs of R&D are labor costs. A move to lower wage countries is expected, to follow the trends of other industries. China and India are looking from the surface most potential to become R&D labor cost cutting countries. The big question though is, can these countries cope with the high quality requirements of personnel. What is positive in respect of R&D Biotech, is the innovation rate of new products. Compared to R&D investments of Pharma (52 billion $), Biotech invests 15 billion $, but got 100% more new molecular entitities approvals. With this in mind, the industry expects R&D investments to shift from Pharma to Biotech.

Major Biotech companies are: Amgen, Genentech, Genzyme, Wyeth, BiogenIdec, Millenium pharmaceuticals, Millipore, AstraZeneca, Parexel, Cytyc, Abt. Associates Clinical trials, Chiron, Gilead Sciences, MedImmunr, Biovail and Abbott. Major research institutions are: National institute of health (NIH), Chemical abstracts service (CAS), NCBI, National institute of standards and technology, Food and drug administration, European Molecular Biology Laboratory, UC Berkeley, UC San Fransisico, UC Stanford.

The leading places in the world for biotech research for medical applications can be sorted by number of companies as follows: US (1450), Canada (450), Germany (380), UK (370), Australia (210), France (210), Sweden (180), Israel (175), China & Hong Kong (170), Switzerland (165), India 100, Netherlands (90). When you look from a different point of view to the leading Biotech places, you can look at the Biotech-Biotech and Biotech-Pharma alliances: US (337), UK (105), Germany(103), Switserland (70), Canada (53), France (48), Denmark (25), Netherlands (23), China (5), India (4).

What is the role of the traditional medicine industry? Traditional Pharma will defend there market positions that are threathened by new Biotech products. On the other hand Biotech is expected to implement new products on the longer term. Genetically-modified products and biofuels will add value for society in terms of increased productivity, decreasing reliance on pesticides and minimizing the amount of runoff from tilling. Pharma is lobbying against biotech-based medicine and influecing the public opinion. On the other hand The Biotechnology industry organisation is trying to calm down the negative publicity and is participating in every relevant policy debate. The FDA will be the key to succes for Biotech to have good biotech products on the market that don’t hurt the biotech image. As stated before Biotech companies get into alliances with Pharmaceutical companies more and more (813 in 2004 versus 641 in 2003). This implicates that Biotech is at least worth to invest in, also for traditional focussed pharma companies

In 2004 Ernst&Young predicted that the Biotech market would significantly consolidate through mergers and acquisitions. Particularly smaller and undercapitalized companies would be involved. Until now the consolidation did not happen. Instead of merger and acquisitions, strategic alliances were formed, to be able to invest in R&D. For the future it is still expected that a consolidation trend wil occur. Large, well funded pharmaceutical companies might invest in Biotech companies, so that the smaller companies can develop succesful products.

The annual forecasts of the 10 leading companies in the biotechnology sector (marketcapitalization of 271 million $, which is 75% of total market capitalization) show a significant growth expectation of 19% average for 2005.

R&D money currently flows to nanotechnology, molecular cell biology, microbiology, tissue and stem cells, virology, immunology, genetics, bio-fuels.